What does FinQuest

Solve?

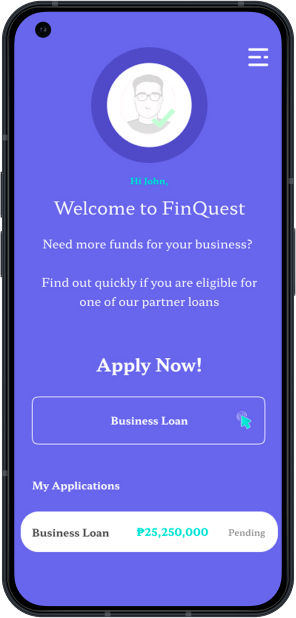

Get the best loans for your business in our platform

Why use FinQuest

One and done loan applications

File only one application for your loan that is sent to all our lenders at once.

Get the lowest

rate possible

Compare interest rates and

terms from multiple partner lenders

Faster turnaround

time

Get a loan faster by automatically applying to multiple partner lenders at once

Hassle free

experience

Faster loan processing

with documents filed

online

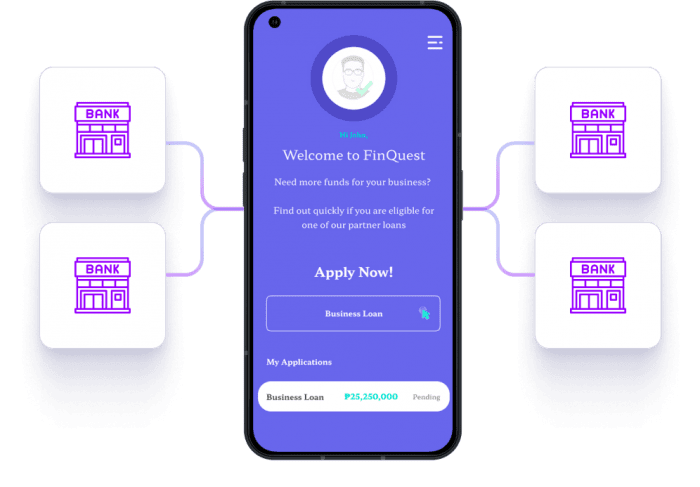

How it works

One application. Multiple Lenders

(pick the most competitive offer)

Why be a FinQuest Lending Partner

Ready access to

potential borrowers:

Choose from a large and consistently flowing pool of leads

Reduce overhead

expense:

No more loan origination cost and business development costs

Easy loan management:

Documents and information stored in a single platform

Faster turnaround times:

Automated workflow to reduce processing costs and time spent

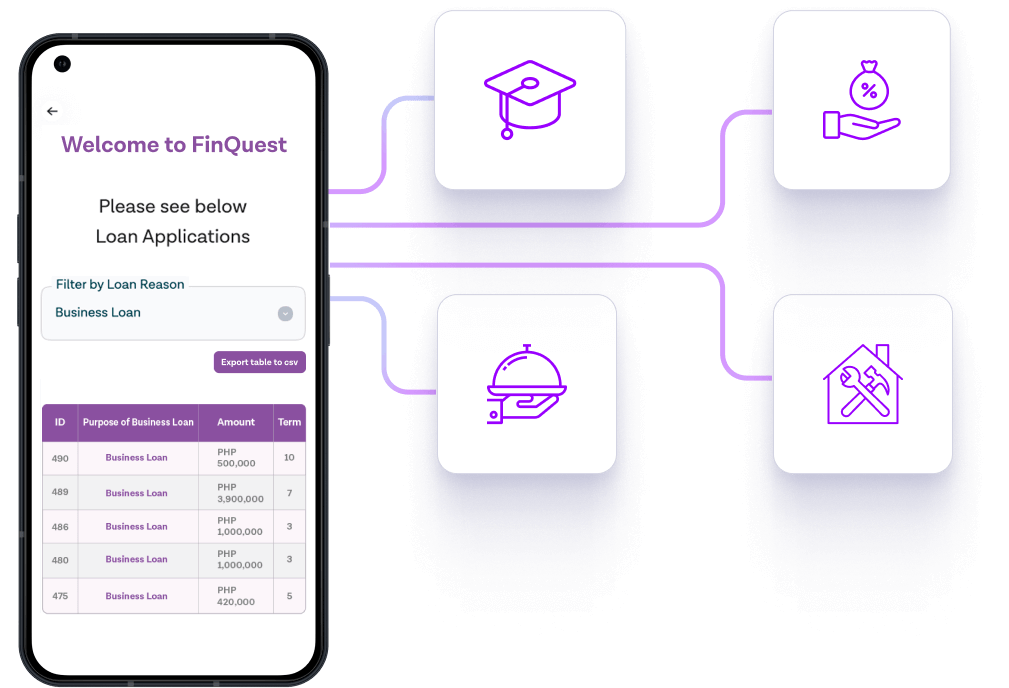

See all Borrowers in One Platform

Frequently Asked Questions

Is FinQuest a Bank or a Financial Institution?

FinQuest is not a bank or Financial Institution. FinQuest functions as a technological marketplace platform to link borrowers and lenders. It’s important to note that our SEC registration explicitly states that we do not engage in any lending activities whatsoever.

For banks and financial institutions, feel free to contact us if you want to become a FinQuest lending partner.

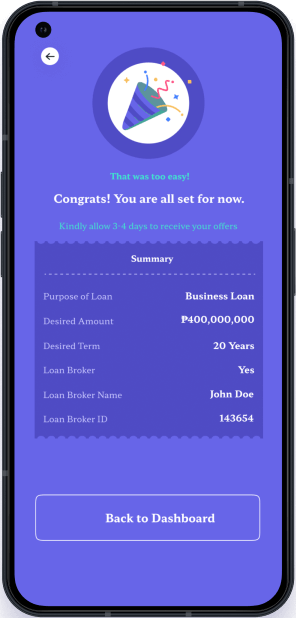

How does FinQuest work?

Prospective borrowers have the opportunity to sign up on our platform. Their application profiles will be promptly shared with all our lending partners, who will assess the applications and extend loan proposals. These potential borrowers will have access to the interest rates and terms presented by our diverse range of lender partners. This empowers them to select the most advantageous option available.

What are the interest rates for your loans?

Unlike other online loan platforms which give out loans at set interest rates, your interest rates at FinQuest will depend on your creditworthiness as a borrower.

Borrowers see the interest rates offered to them by our various lender partners and they can choose the best deal. The more creditworthy you are, the lower the interest rate.

How much does it cost to join the platform?

Enrolling with FinQuest comes at no cost for borrowers, though lenders might impose processing fees for their loans. The positive aspect is that a multitude of lenders are available for selection.

Is FinQuest a peer-to-peer lending platform?

Unlike peer-to-peer lending platforms, FinQuest PH works with vetted banks and financial establishments to provide loans directly to borrowers who have passed their credit requirements, ensuring that all transactions are authentic.

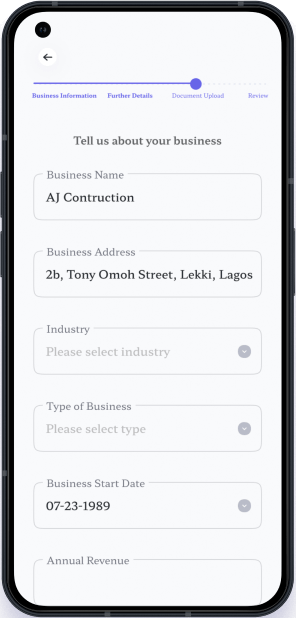

What are the required documents?

Most lenders require a standard set of documents that we ask for. These documents are as follows.

Basic documents for all:

- Business background / Company profile

- Latest 3 years’ Income tax return (ITR)

- Latest 3 years’ financial statements

- List of major customers and suppliers with contact information

- Bank statements (6 months) / photocopy of passbook

- Proof of collateral** If with collateral

Additional documents for Sole proprietorship:

- Certificate of Business registration with DTI

Additional documents for partnership:

- Articles of Partnership

- Certificate of Registration issued by SEC

Additional documents for corporations:

- Articles of Incorporation and by-laws

- Certificate of Registration issued by SEC

- Latest general information sheet (GIS)

Lenders may ask for additional documents as per their internal requirements. We anonymize borrower details until a loan offer is accepted.

How do you protect my Privacy?

Your privacy and the security of your sensitive data are our primary concerns. We ensure this in two ways.

First, when your loan applications are sent to potential lenders, all your project’s information is shared, however, your name and contact details are hidden, until the lenders choose to take on your loan offer, ensuring that you are connecting only with serious lenders.

Second, we adhere to all cybersecurity protocols required by the BSP. Once the loans are accepted, the application and details are completely deleted from our servers, ensuring that copies of your application are not accessible to anyone else.